RED VIOLET ANNOUNCES FOURTH QUARTER AND FULL YEAR 2018 FINANCIAL RESULTS

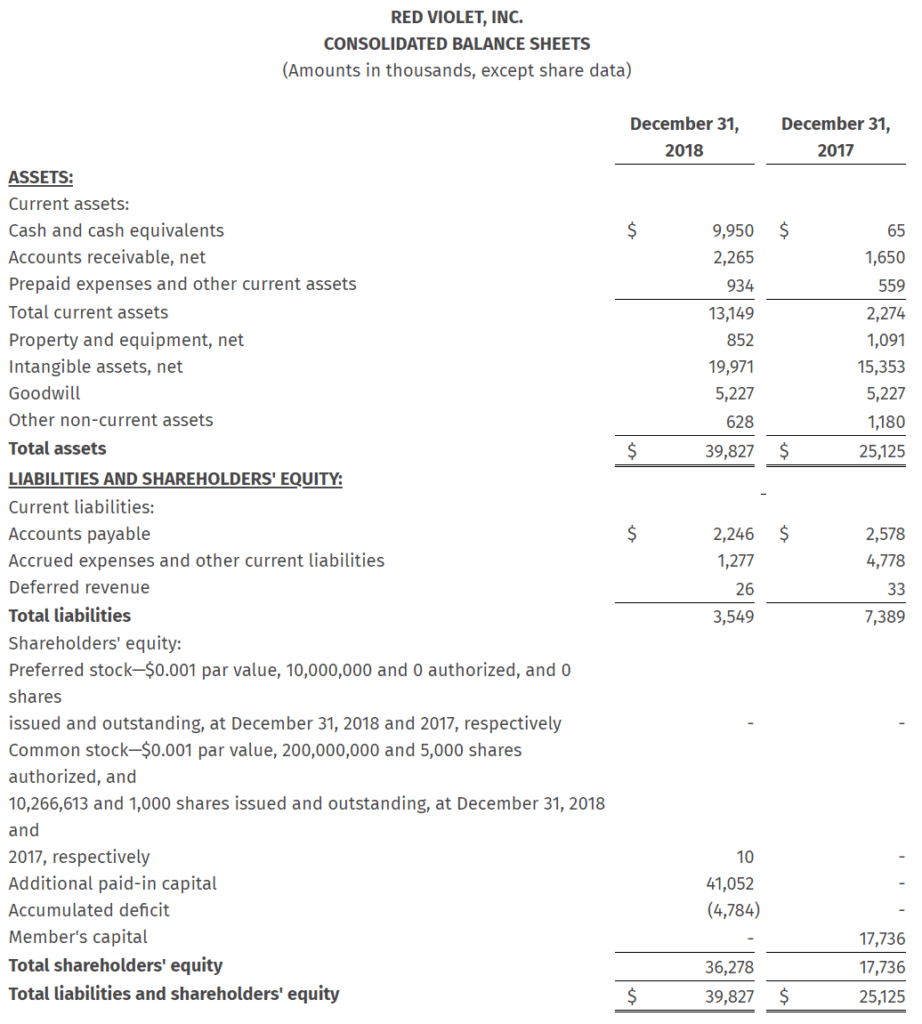

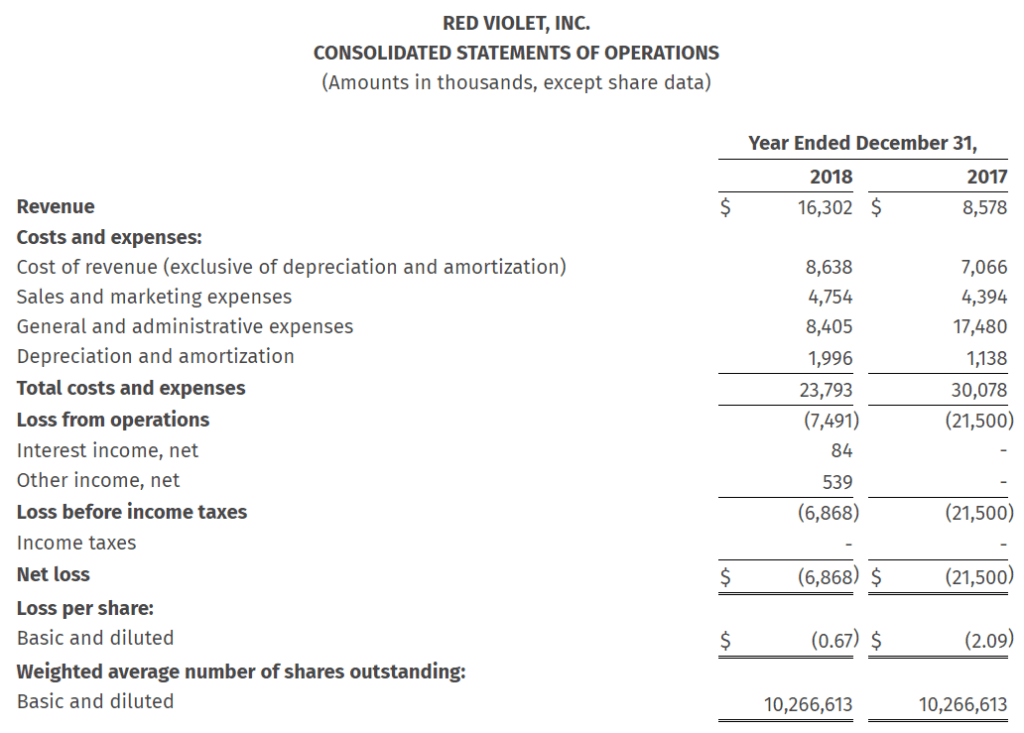

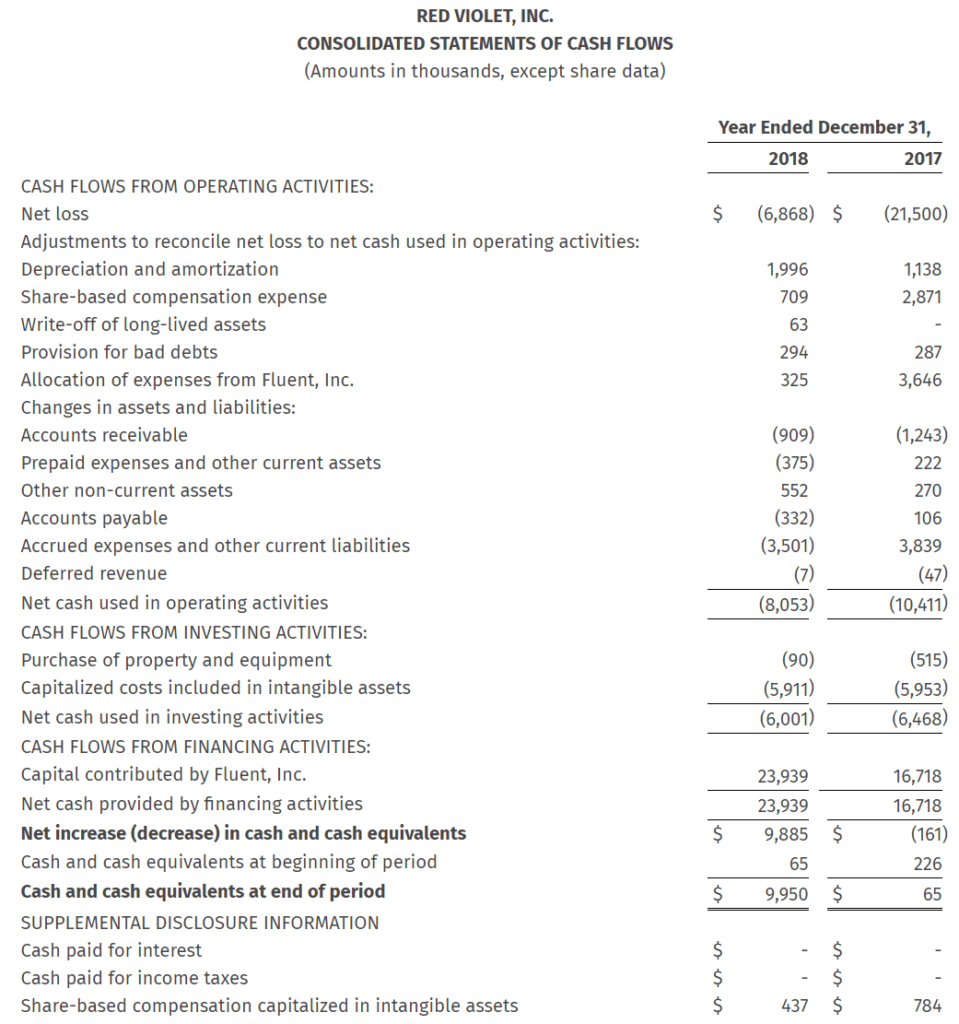

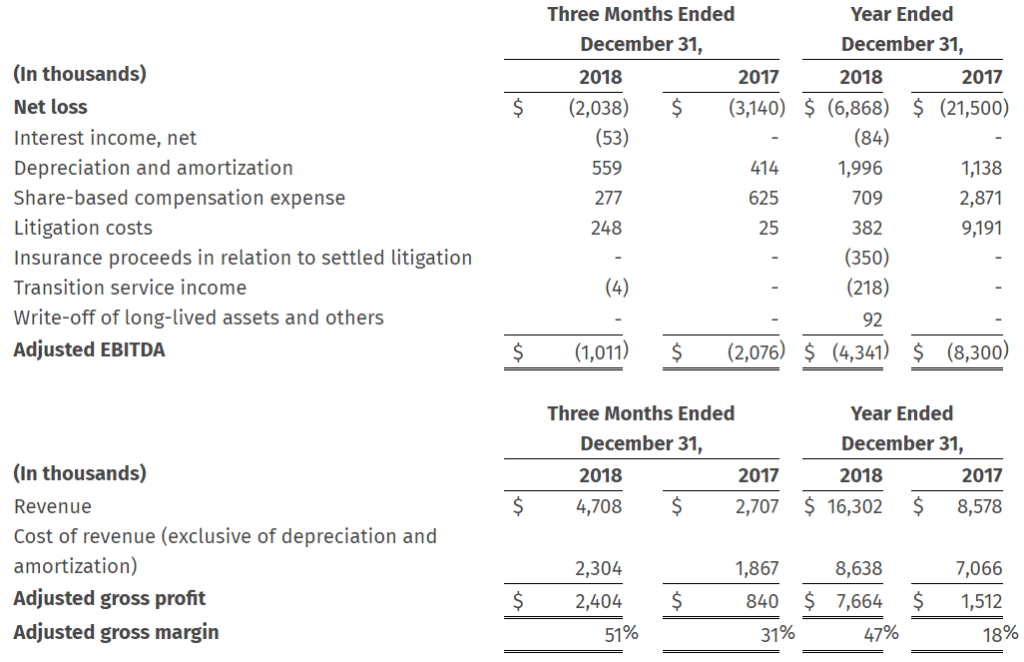

Continued Growth in Revenue and Key Financial Indicators Drives Path to Profitability BOCA RATON, Fla.–(BUSINESS WIRE)–Mar. 7, 2019– Red Violet, Inc. (NASDAQ:RDVT), a leading information solutions provider, today announced financial results for the quarter and full year ended December 31, 2018. “2018 proved to be a transformative year for us, with strong financial performance including 90% year-over-year revenue growth and substantial progress towards profitability,” stated Derek Dubner, red violet’s CEO. “Our solutions are enabling our customers to grow their businesses, which in turn is resulting in increased spend with us. We are seeing greater new customer adoption across all verticals and the first two months of this year indicate that 2019 will be a monumental year for red violet. We are as confident as ever in our path to positive cash flow and profitability.” Fourth Quarter Financial Results For the three months ended December 31, 2018, as compared to the three months ended December 31, 2017: Full Year Financial Results For the year ended December 31, 2018, as compared to the year ended December 31, 2017: Use of Non-GAAP Financial Measures Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted gross profit and adjusted gross margin. Adjusted EBITDA is a financial measure equal to net loss, the most directly comparable financial measure based on US GAAP, excluding interest income, net, depreciation and amortization, share-based compensation expense, litigation costs, insurance proceeds in relation to settled litigation, transition service income, and write-off of long-lived assets and others, as noted in the tables below. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. About red violet® At red violet, we believe that time is your most valuable asset. Through powerful analytics, we transform data into intelligence, in a fast and efficient manner, so that our clients can spend their time on what matters most — running their organizations with confidence. Through leading-edge, proprietary technology and a massive data repository, our data and analytical solutions harness the power of data fusion, uncovering the relevance of disparate data points and converting them into comprehensive and insightful views of people, businesses, assets and their interrelationships. We empower clients across markets and industries to better execute all aspects of their business, from managing risk, conducting investigations, identifying fraud and abuse, and collecting debts. At red violet, we are dedicated to making the world a safer place and reducing the cost of doing business. For more information, please visit www.redviolet.com. FORWARD-LOOKING STATEMENTS This press release contains “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipate,” “believes,” “should,” “intends,” “estimates,” and other words of similar meaning. Such forward looking statements are subject to risks and uncertainties that are often difficult to predict, are beyond our control and which may cause results to differ materially from expectations, including whether 2019 will be a monumental year for red violet and whether red violet will achieve positive cash flow and profitability. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this press release and speak only as of the date of this press release and are advised to consider the factors listed above together with the additional factors under the heading “Forward-Looking Statements” and “Risk Factors” in red violet’s Information Statement filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 27, 2018, as may be supplemented or amended by the Company’s Quarterly Reports on Form 10-Q and other SEC filings, including the Form 10-K for the year ended December 31, 2018 expected to be filed prior to its deadline. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Use and Reconciliation of Non-GAAP Financial Measures Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted gross profit and adjusted gross margin. Adjusted EBITDA is a financial measure equal to net loss, the most directly comparable financial measure based on US GAAP, excluding interest income, net, depreciation and amortization, share-based compensation expense, litigation costs, insurance proceeds in relation to settled litigation, transition service income, and write-off of long-lived assets and others, as noted in the tables below. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. We present adjusted EBITDA, adjusted gross profit and adjusted gross margin as supplemental measures of our operating performance because we believe they provide useful information to our investors as they eliminate the impact of certain items that we do not consider indicative of our cash operations and ongoing operating performance. In addition, we use them as an integral part of our internal reporting to measure the performance of our business, evaluate the performance of our senior management and measure the operating strength of our business. Adjusted EBITDA, adjusted gross profit and adjusted gross margin are measures frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies similar to ours and are indicators of the operational strength of our business. Adjusted EBITDA eliminates the uneven effect of considerable amounts of non-cash depreciation and amortization, share-based compensation expense and the impact of other items. Adjusted gross profit and adjusted gross margin are calculated by using cost of revenue (exclusive of depreciation and amortization). Adjusted EBITDA, adjusted gross profit and adjusted gross margin are not intended to be performance measures that should be regarded as an alternative to, or more meaningful than, either loss before income taxes or net loss as indicators of operating performance or to cash flows from operating activities as a measure of liquidity. The way we measure adjusted EBITDA, adjusted gross profit and adjusted gross margin may not be comparable to similarly titled measures presented by other companies, and may not be identical to corresponding measures used in our various agreements. View source version on businesswire.com: https://www.businesswire.com/news/home/20190307005222/en/ Source: Red Violet, Inc. Investors Relations Contact:

Camilo Ramirez

Red Violet, Inc.

561-757-4500

ir@redviolet.com